Every two weeks I’m up at the crack of crack paying bills online. My other half has put me in charge of paying his bills because he admittedly isn’t good at it. One of his bills happens to be a store card that has a promotional deferred interest rate that will expire in two months. He wasn’t sure exactly what that meant, do you?

From time-to-time stores will have promotions that are designed to get you to buy. The are often advertised as “No Interest for Six Months” or “No Interest for One Year”. Have you seen those types of offers? This is called a deferred interest offer. This means that the credit issuer will not charge you any interest during the promotional period.

This can be an awesome tool for saving money if you are making a large purchase. If you have the funds to purchase the item outright, you can hold on to your money and earn interest. If you do not have the money to make the purchase but absolutely need the item, this can buy you time to pay the item off without paying any fees. Finally, if you have little or no credit history, this can help you build credit.

I’ve used such an offer to purchase an expensive mattress to help with my bad back. In this case my other half used this offer to purchase a television worthy of Sunday football. The sales person was so good he also picked up a tablet as well. No problem with that, but he did not read the fine print.

You see, when you have a deferred interest finance offer, this doesn’t mean that there is never any interest. It simply means that if you pay the item off within the promotional time that you will not be charged any interest. It is extremely important that the balance be completely paid off in that time. If you owe as little as one penny it can cause you hundreds of dollars in interest. How?

These offers are typically made by financing companies who generally charge above 20% interest. During the deferral period you will not be charged any interest if your balance is paid off within that time, however, your balance is actually accruing interest in the background. If you do not pay the balance off in time, you will be charged interest from the day that you purchased the item. I put that in bold because I want you to really understand that. If you don’t pay the balance off, they will charge you interest from day one. Ouch.

But, all is not lost. Each credit issuer is required to tell you how much the potential interest charge will be and exactly when the promotion interest period expired. The trick is to actually take a look at your credit statement. My other half gets his bills online and never paid attention to the statement. Instead he just looked at how much was due. The other thing to note is that the minimum payment due is not designed to have you repay your balance within the allotted period.

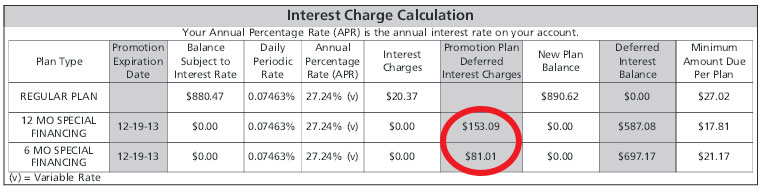

Take a look at the bottom of his statement below:

You can click to enlarge.

There is a column called “Promotion Plan Deferred Interest Charges” and there is also a column called “Promotion Expiration Date”. These are probably two of the three columns that you need to pay the closest attention to. The final column is the “Deferred Interest Balance”. Note that these three columns are highlighted on the statement in gray.

If you pay off the Deferred Interest Balance by the Promotion Expiration Date then you will avoid paying the the Promotion Plan Deferred Interest Charges. On the statement above there is a potential interest charge of at least $234 that will be added to the balance.

The final offense? Well, if you don’t pay off the promotional balance in time, not only will the interest charge be added to your account but you will then have to pay interest on that interest charge balance. In this case he would be paying 27.24% interest on the $234 once it is added to the account balance…if it isn’t paid off in time. Don’t worry, it will be.

So, as you can see, deferred interest charge credit cards are not, by themselves, bad things. Every major store probably offers this deal and you can also secure this offer using Bill Me Later at thousands of stores and even airlines online. I’ve used it many, many times. The catch here is that you have to know all of the fine print and make sure that you pay off the balance before the the promotion expiration date.