If you’re not paying pay cash during the past Christmas season, your credit card bills from the 2018 holiday season will start hitting you mailbox in January. Are you ready to feel the pinch from buying grandma that must have sweater for Christmas?

According to the National Retail Federation, holiday sales is expected to increase by 4.3% to 4.8% to between $717.45 billion to $720.89 billion in overall spending. That’s a pretty big jump compared to annual increases of about 3.9% annually. The average American consumer’s budget for holiday gifts ring in at $805. It will take the average American until May to pay off Christmas bills. That leaves you only 7 months before you begin charging Christmas 2019’s gifts to your cards again.

If you do not want to wait until May to watch those charges drop off your credit cards, begin implementing my post holiday debt reduction plan now!

Stop Charging

If you continue to use your credit card, not only will it take you longer to get rid of the holiday debt, but, you will also pay more interest to do so. Stop adding to the debt by paying cash when you can and by delaying purchases.

Make Some Quick Cash

Is there anything sitting around the house that someone else might want? Get thee to Craigslist, eBay or any other site where you can sell those goods. Remember the old adage, one man’s junk is another man’s treasure. Someone is willing to pay for your junk on all sorts of platforms including Facebook. You can also try to implement a side hustle to make extra money.

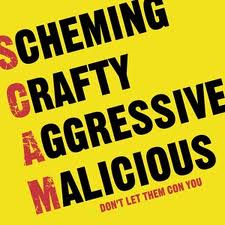

Negotiate A Lower Interest Rate

If you’ve been a great customer and you have decent credit, now is the time to cash in. Call your credit card issuer and ask if they have a promotional or lower interest rate that you may qualify for. If approved, you’ll save money in interest fees lowering the overall amount that you will have to repay.

Use Your Tax Refund

Are you expecting a tax refund? File your taxes early and use that cash to repay your credit card. In 2017, the average refund was about $2,763. Last year the IRS sen tout over $324 billion in tax refunds. That’s a whole lot of cash. Instead of splurging on yourself, pay your credit card bill.

The next time that Christmas rolls around – and this tends to happen every year – be a smart shopper by planning and saving ahead of time. Your wallet will thank you for it.