I’m going to buck what everyone else is going to tell you about your personal finances. Come closer, I have a secret to share: living paycheck-to-paycheck won’t kill you. I know that if I am being responsible I shouldn’t say that, but let’s drop all that responsibility mess out of the window and be real for a moment. Have you ever lived from one paycheck to another? You’re breathing aren’t you?

According to a 2008 survey by Career Builder, almost half of all American workers sit by the ATM waiting for their deposits to show up on Fridays. Well, maybe they didn’t put it exactly that way, but you know what I mean. What does paycheck-to-paycheck mean? If you do a search on Wikipedia for that terminology, you are redirected to the “working poor” entry. So, the Wikipedia entry says, “Working poor is a term used to describe individuals and families who maintain regular employment but remain in relative poverty due to low levels of pay and dependent expenses. The working poor are often distinguished from paupers, poor who are supported by government aid or charity.” Sounds like a lot of us. I my friends, am the the working poor. Or am I?

I know that I am supposed to have 6 months of income saved in an account somewhere, but I don’t. You know that I don’t. If I lost my job tomorrow, I’d be looking around for a job that night and applying for unemployment the week after. But does a job loss immediately mean financial ruin? I don’t think so. Over the past year I have worked hard at establishing alternate sources of income. In the case of a sudden loss of employment I would turn to that list…in addition to unemployment. Monthly rent from the house is $525 which is more than one week of pre-taxed unemployment in New York. I would also drop any unnecessary services. That would mean cable and internet. I have no problem grabbing my laptop and sitting outside my mom’s house (conveniently across the street, a couple of houses down) and stealing, uh, borrowing her internet. I already learned how to clean my suits and clothes without the dry cleaners. I would drop full coverage insurance on the car and walk my butt up to public transportation. Gym membership? Gone. Meat? Big bag of bulk hormonally induced chicken. The student loan people would give me a hardship deferment. eBay and Craigslist would empty out the house. Puppy might have to get a job.

At this point you’re probably wondering why I haven’t done that already to get myself out of debt. The reason is simple, like many other “working poor”, I’m not really part of the working poor. I’ve made decisions to spend money on certain things that makes my life more comfortable. It causes me to not have much savings which lands me into the paycheck-to-paycheck category, but I am not “in relative poverty due to low levels of pay”. The sad fact is that lots of people with paychecks much bigger than mine and yours live paycheck-to-paycheck. The problem is not the pay. The problem is living outside of your means.

You can successfully live paycheck-to-paycheck, however, if you find yourself paying overdraft fees while waiting for your check to clear; or if you are dodging bill collectors; if your rent and other bills are always paid late; if you skip critical services; if you have to stop at the bank every single time that you are paid to make it through that very day, then take those things as warning signs. Be prepared to reduce your spending and live less comfortably before your status changes from “working poor” to “pauper”.

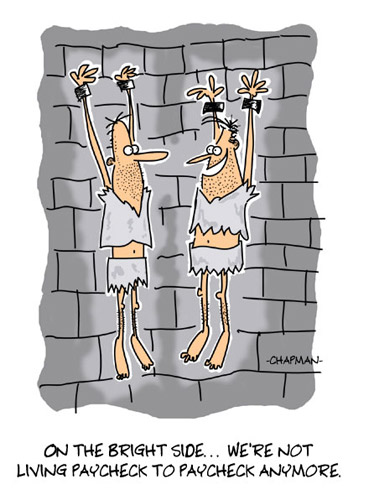

Image found at moniqueschlosser.com