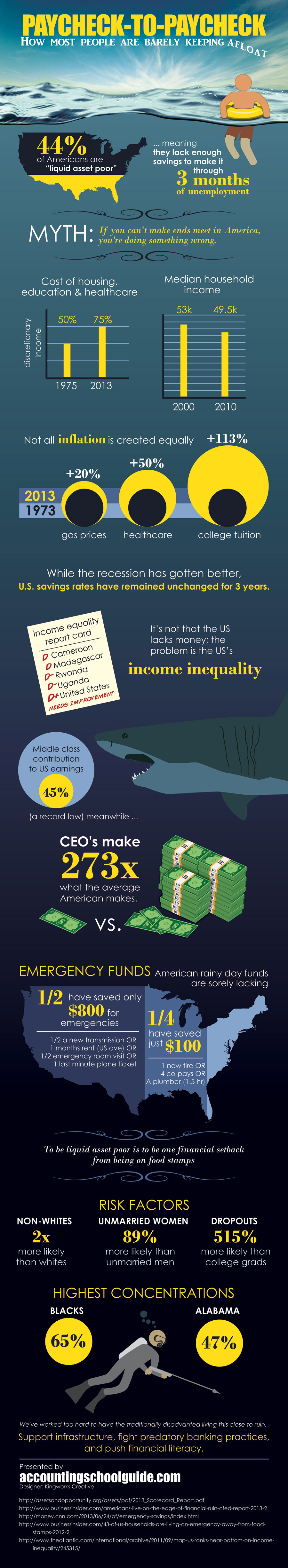

According to the infographic below nearly half of all Americans are living paycheck to paycheck. In case of emergency, 25% of Americans have only $100 saved to contribute towards paying for an emergency. But if you think that it’s because Americans just suck at saving, that’s not the only reason. While inflation is on the rise, real income has decreased since the recession. Think about it: how much more are you paying for housing and food than you paid three years ago and how much higher is your paycheck?

Check out the infographic below for more information on just who is more likely to be living paycheck-to-paycheck. Hint: Women dominate this list.

Source: Accounting School Guide