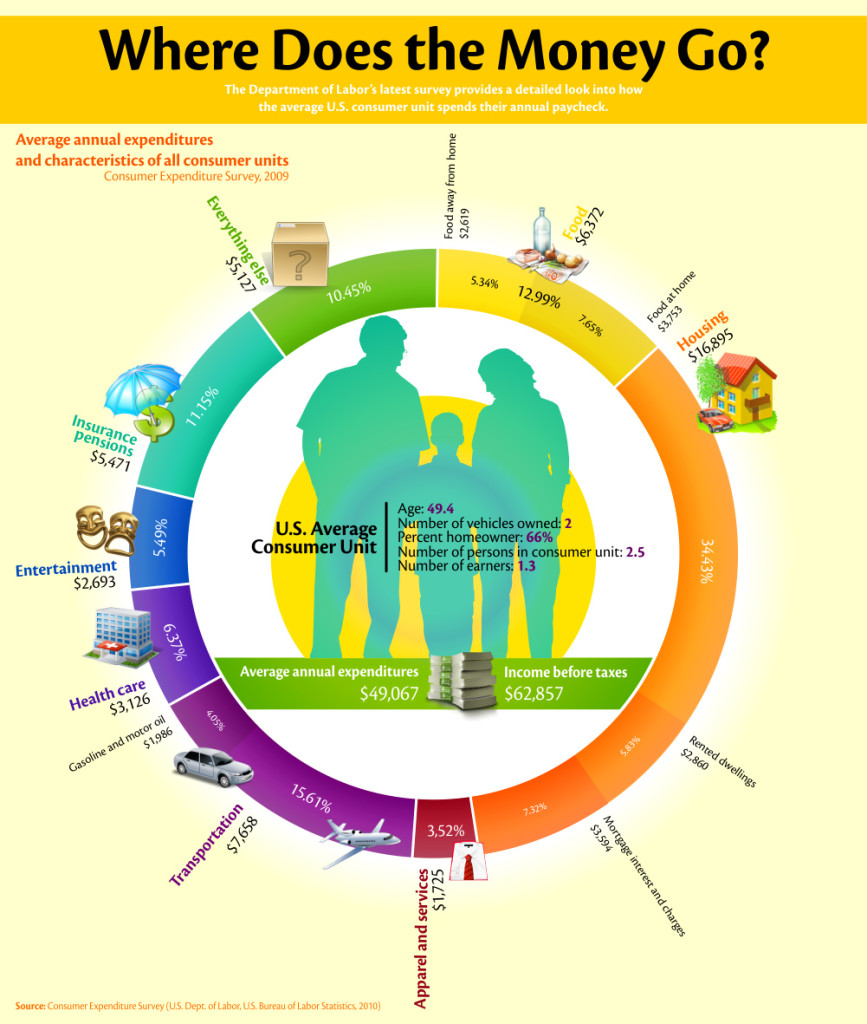

The Credit Loan blog had a very interesting infographic chronicling how the average consumer spend their paycheck. The infographic was compiled from a survey conducted by the Department of Labor.

We like to cry broke, but according to the information, the average family has an income of $62,857 before taxes but spends about $49,067. Not surprisingly, housing costs account for almost 35% of the total amount that the average family spends. Considering that about 66% of households are homeowners, if you sell your home and begin renting, you might realize some savings in this area.

The next two largest areas of spending, transportation (almost 16%) and food (almost 13%) are necessary, but again, a diligent person can save money in these areas. You have to eat and you have to get to work, but if you hold on to an old car longer and implement some of my methods of saving money on gasoline, you might end up with more cash in your pocket.

We all have to eat, but eating less meat, packing your lunch and eating out less frequently can add up to significant savings at the end of the year. Also, buying in bulk and growing a summer garden can also help.

If you have a moment, take a good look at this infographic. It was eye opening for me. Click to enlarge.

This post was included in ther Festival of Frugality at Living Richly On A Budget.