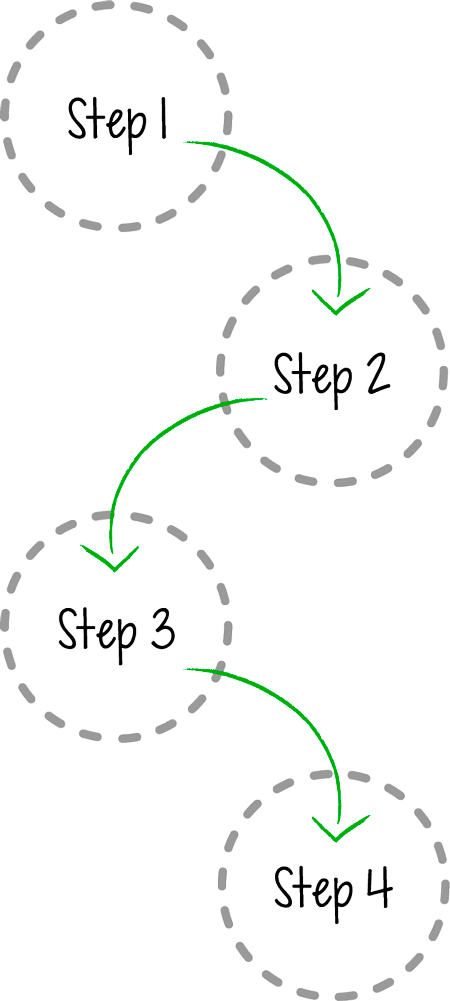

The step-by-step, proven system

for mastering your credit

Do you want to understand how your credit works,

but you have no idea where to start?

You don’t know where to begin

Jane is really excited about the idea of improving her credit profile. She’s spent a lot of time reading blogs and watching videos, but even with all this knowledge, she doesn’t actually know where to start. And worse… she feels like she’s missing her chance.

Or you’ve tried and failed

John has tried every trick in the book. He’s spent money on training and tools, maybe even credit repair services, but nothing gets him real results and everything about his credit is still a mystery. Everyone makes it sound like it should be so easy… so why doesn’t he get it?

Everyone promises you this…

![]() The secret credit formula that will show you something that no one else knows about your credit.

The secret credit formula that will show you something that no one else knows about your credit.

![]() Guaranteed proven letters that will remove negative items from your credit report.

Guaranteed proven letters that will remove negative items from your credit report.

![]() Huge increases in your credit score that will occur only if you follow their tips.

Huge increases in your credit score that will occur only if you follow their tips.

![]() You’ll never pay high interest. Because, that secret information that they are privy to will ensure that your interest rate is near zero.

You’ll never pay high interest. Because, that secret information that they are privy to will ensure that your interest rate is near zero.

But here’s what REALLY happens…

You never even get started

![]() The secret credit formula never seems to materialize.

The secret credit formula never seems to materialize.

![]() Guaranteed proven letters are not so guaranteed.

Guaranteed proven letters are not so guaranteed.

Or you get ZERO results

![]() You’re still waiting for those massive credit score increases that you were promised.

You’re still waiting for those massive credit score increases that you were promised.

![]() Not only does your interest rate not change, you don’t even know how it’s calculated.

Not only does your interest rate not change, you don’t even know how it’s calculated.

![]() You’re left CONFUSED.

You’re left CONFUSED.

Wouldn’t it be nice to find something that ACTUALLY works?

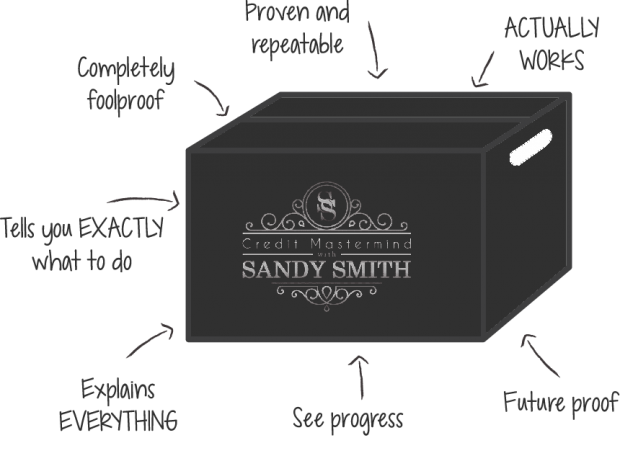

One that kills indecision by telling you exactly what to do next, every step of the way

One that explains everything, in detail, and doesn’t make you search for things to fill in the gaps.

One that is achievable so that you can implement what you learn right away.

One that’s pretty foolproof…if you can read, you can do this.

One that is “future proof” because once you’ve learned how to fix things yourself, you’ll never be left behind.

One that is repeatable. This works every single time because you learn everything from the ground up.

I went from a 620 credit score to an 847 credit score

and you can learn how to do the same.

My name is Sandy and since 2009, I’ve been working my way out of debt. When I started, I

didn’t have the luxury of even thinking about my credit score. In fact, I actually thought that my 620 credit score was pretty good. Boy, was I wrong and naive.

I first starting paying attention to my credit score as my debt started to go down and I needed to buy a car. Sure, I made enough money, but I didn’t qualify for the 0% interest rates that were always advertised on television.

Why not?

It wasn’t until the car dealer explained to me that I needed to have a much higher credit score that I finally realized the impact that my credit score could have on the overall cost of the things that I needed to buy.y

That one incident piqued my interest and I started to research everything related to improving one’s credit without a credit repair agency. What I found was shocking! No, you’re just expecting me to say that.

What actually happened was that it took me a while to put it all together. I went to many different, reputable sources to find information and what actually made up my credit score and how I could improve my credit while minimizing the amount of interest and fees I paid.

For example, did you know just by just paying a little bit on  your credit card early in the billing cycle reduces your overall interest? Who knew?! They didn’t

your credit card early in the billing cycle reduces your overall interest? Who knew?! They didn’t

teach me that in school so I just paid by the due date. Not so smart.

That’s why I went back to school to become a Certified Financial Education Instructor. I wanted to learn what I could about credit, then I wanted to learn how to teach YOU everything that I had learned.

Mastering your credit doesn’t have to be difficult, but it does take the one thing that no one wants to share with you – time. It takes time to figure it all out and then put what you’ve learned an action plan.

That’s why I’ve made it all very, very simple for you. Not only will I teach you about the components of what does into calculating your credit score, but I’ll give you actionable tips that you can begin implementing right away to turn your own credit around.

I’ve been successful at teaching people who know absolutely nothing about credit and finances, everything that they need to know to turn their be their own credit repair services, and I’ve done so for quite some time.

If you don’t have the confidence to get started, I promise, you can and do this by yourself, and once you’ve learned everything, you will be the master of your own credit without anyone else.

The absolutely easy system that made it possible.

Over the years I’ve developed my own system for teaching others about credit. Financial education doesn’t have to be stuffy and boring. In fact, I’ve found that when I make education FUN, you have a good time AND you remember things much easier. So here’s how I teach you about improving your credit.

I start with the very basics. It’s kind of like learning the alphabet so that you can learn how to read words. I take us all the way back to basics by explaining each component that makes up your credit score. Oh yeah, and since you have multiple credit scores, I don’t just teach you the basics the affect your FICO score, but your Vantage score as well.

Next we’ll cover pulling and decoding your credit report. If you’ve ever pulled your report before but didn’t really understand everything that you were looking at, this is a pretty important class. You can’t fix your credit until you know what’s on it.

If you do have erroneous items on your credit report, fixing them can have an immediate positive effect on your credit score. Do you know how to fix errors on your credit report? Don’t worry, I’ve got you covered there too. I’ll give you step-by-step instructions on how to get it all accomplished, with sample letters as well. It’s pretty much fool proof.

We then move on to how to read your credit card statement. I bet that you think that you know everything that there is to know about your credit card statement. It’s simple, right? Answer this. What is the cut off time for when your payment is applied? Don’t know? That’s why this class is important.

No errors on your credit report? Then it’s time to move on to one of the most overlooked tools that helped me repay my debt quickly – balance transfers. I’ll teach you everything that you’ve never learned about balance transfers and how I’ve managed to carry a high balance at a 0% interest rate for over five years.

Finally, if you’re ready to enter the 800 club, the final class will get you there. Once I crossed the 800 threshold, I took time to learn what had really gotten me there. Being rich won’t do it. Having lots of money in the bank doesn’t do it either. There are simple and consistent habits – plus time – that will get you into the exclusive club on the way to perfect credit.

STOP! This class isn’t for everyone.

I don’t want to waste your time, so before you go any further see if you answer “yes”

to any of the following which are deal breakers.

Are up considering a bankruptcy filing?

Don’t let this class delay you. Go ahead and consult with an attorney to get that started.

Feel like you’re just too busy? No time?

Yeah, this might not be for you either. You’ll need time to learn and understand the concepts to put them into action. I don’t want you to take this class if you don’t have time to implement the changes.

Want to hire someone else to do this?

I can refer you to a wonderful Licensed Financial Advisor who can do the work for you AND educate you as well.

Reading not your thing?

Yeah, you’re not going to like this class either. Sure there are recordings, but you have to read as well. Sorry, this isn’t a video or audio only class.

Have no credit at all? As in no credit profile?

You’ll need to learn how to establish your credit. That’s a separate thing and I can refer you to someone to help.

Don’t think that you need it all?

That’s okay, you don’t have to take the entire course. I have a solution for you as well.

Here’s how the class works.

Choose the best method that will work for you.

Here’s what people are saying.

caret-downcaret-upcaret-leftcaret-right Kadeem B.

Kadeem B.

I had a nearly $4,000 medical bill that went into collections and was killing my credit.

Sandy showed me how to negotiate so that I paid less than half of what I owed and had it removed from my credit report.