I love these update posts. Six months ago I joined a challenge created by Jeff Rose of Good Financial Cents along with with like-minded personal finance writers who wanted to see how a $1,000 investment would pay off at the end of the year. The goals were pretty simple:

- Show you how easy it is to get started investing

- Show you the plethora of online options available

- Show you different strategies that you can try

- Erase any doubts that you can’t do this on your own.

Pretty much all of the challengers decided to invest in the stock market. A few others had some non-traditional investment options such as peer-to-peer lending in their portfolio. I decided to split investment with 25% into peer-to-peer lending, 25% into the stock market and 50% into a small business. Let’s see how I’m doing. First, the disclaimer.

Disclaimer

Come on guys, you know better than to take any investing advice from me. I’m investing my own money to show what can happen with investing and with a small business. I do not make investing advice, nor do I make purchase recommendations. Finally, my results won’t guarantee you a damned thing.

I’m gonna need a little help from Clint Eastwood circa 1966 to review the good, the bad and the ugly in my portfolio.

The Good

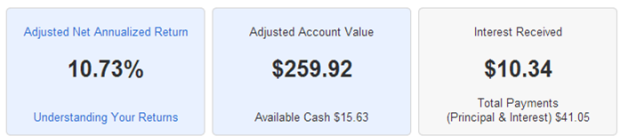

My Lending Club account is doing well. I invested $250 here and my adjusted return rate is 10.73%. My portfolio is now worth $259.92. I’m pretty happy about that because I am getting an interest rate that is 1,000x the average bank account interest rate of 0.01%. The difference here is not just the interest, but the risk that I am taking in losing every penny that I have invested. Again, I’m okay with taking this risk. I currently have a Prosper.com peer-to-peer lending account, but I’m letting that wind down and I’ll be switching some of my own personal investments over to Lending Club. I’ve found that I prefer their platform and quite honestly, I just trust them more. You can read more about how Prosper lost my trust here. Clueless about peer-to-peer lending? You’ll want to read Finance 101: What The Heck Is Peer-to-Peer Lending?

Position: POSITIVE. Net Increase: 3.97%

The Bad

The stock market is trucking along like nobody’s business. The Dow is setting record after record this year, but I almost wished that we had started the challenge in that serious dip right there at the beginning of February. That downward looking ski slope that started in January would have been an optimal time to buy, but you can never time the market. What you should be doing is consistently buying as the market goes up and down so that your cost averages out.

I’m talking stock market because I dipped my toes into the market and spent $250. I believe in buying what you know or what you believe in when investing in individual stock. I chose to drop my cash on a company called Solarcity Corp (SCTY) because I believe in their products and their leadership. I’m going to drop their public profile here:

SolarCity Corporation provides clean energy services. The company offers solar power, energy efficiency and electric vehicle design, monitoring and maintenance services to homeowners, businesses, schools, non-profits, and government organizations in the United States. SolarCity is headquartered in San Mateo, California.

Officers: Elon Musk, Chairman Lyndon R. Rive, Founder; Chief Executive Officer and Director Robert D. Kelly, Chief Financial Officer

If you look closely at the officers, you’ll see that Elon Musk is the Chairman. He’s the CEO of Tesla Motors and is also credited with being a co-founder of both PayPal and SpaceX among other start-up companies. He’s what I like a call a serial disrupter. I get his business sense and I believe in the company. Combine that with Home Depot signing a deal to provide solar panels manufactured by Solarcity in their big box stores.

The stock was trading in the high $70’s when I put in a buy order. With only $250 to invest, $5 of which would be the trading fee, I could only afford 3 shares after the purchase executed at $81.56 per share. Not to worry! The stock was on the upswing…and then it wasn’t. I actually purchased the stock right before it hit the 52 week high of $88.35. The stock then fell so hard and so fast that I received a notice in the mail from attorneys looking for a lead plaintiff to sue the company for defrauding investors. I only had $250 to lose in this portfolio, so it didn’t matter much to me…except that I had also invested in the company in my IRA and that wasn’t play money. But, I also believe in taking a risk and this is a risky company.

The stock fell all the way down to the high $40’s per share. That was a great time to buy because the stock then shot back up to over $70 per share after Solarcity signed a major deal with an energy provider. This is where dollar cost averaging would have come in handy and averaged out your purchase price. I actually did that in my IRA and while I’m still in the red with that particular investment, it’s only down slightly. In my challenge portfolio I lost $50 but still managed to break even. How? Sharebuilder gave me a $50 credit for opening the account, so I actually have $250.01 in my portfolio. Go figure.

The stock fell all the way down to the high $40’s per share. That was a great time to buy because the stock then shot back up to over $70 per share after Solarcity signed a major deal with an energy provider. This is where dollar cost averaging would have come in handy and averaged out your purchase price. I actually did that in my IRA and while I’m still in the red with that particular investment, it’s only down slightly. In my challenge portfolio I lost $50 but still managed to break even. How? Sharebuilder gave me a $50 credit for opening the account, so I actually have $250.01 in my portfolio. Go figure.

Position: NEUTRAL. Net Increase: 0%

The Ugly

I had to breeze through the peer-to-peer lending area to save room for this area. Okay, a full 50% of my challenge dough ($500) went into  small business that I created selling stuff online. I purposely chose to sell on Amazon.com because the barrier to entry is minimal. You can pay $39.99 per month to sell or you can pay $1.00 per item plus a heft fee when each item is sold. I just happen to design and sell custom iPhone cases. My brother manufacturers and drop ships them for me. I wouldn’t be me if I didn’t plug my latest design to the left. On to the moolah.

small business that I created selling stuff online. I purposely chose to sell on Amazon.com because the barrier to entry is minimal. You can pay $39.99 per month to sell or you can pay $1.00 per item plus a heft fee when each item is sold. I just happen to design and sell custom iPhone cases. My brother manufacturers and drop ships them for me. I wouldn’t be me if I didn’t plug my latest design to the left. On to the moolah.

Okay, I set out to prove that a small business can beat the pants off investing hands down. Let’s be clear though that investing can be incredibly passive – you transfer money into an account, buy something and wait. With your own business you must invest not just your funds but a significant amount of time as well, based on how your business is structured. Since I have set my business up with a drop shipper, the amount of time that I have to spend with this business is as minimal as I can make it. The vast majority of my time was taken up at the beginning with making about 100 different designs to sell. Now, I have added just three designs in the past three months. As I get closer to Christmas, I will begin to ramp up designing again which should hopefully pull more customers.

The numbers that you see below are just sales and expenses through Amazon. Remember, there are fees such as paying for the item themselves, mail box rentals, internet costs, additional phone numbers for customer service, etc., that you might need. Thankfully, I share the mailbox that I use for this site with my business; I have use a free Google Voice number that forwards to my cell phone for customer service and my brother takes care of most other things. I pretty much just send orders to him daily and send him a check monthly. What’s not reflected here is the cost of my time. My time has to be worth something! I’m not sure what to charge the business for my time, but for now, I’ll take the usual start-up entrepreneur route of charging nothing.

Through June 30 I’ve sold $6,083.26 and had $1,893.81 in expenses from Amazon. The cost of goods sold was approximately $1,388. Just doing the math, I’ve netted $2,801.45 from my sales on Amazon alone. Remember, I also have sales from my website and from Etsy. It’s not money to retire on, but it’s beating the pants off the other two. Why did I call this one the ugly? Because it’s criminal how UGLY I’m beating the others in this challenge with my little side hustle.

Position: POSITIVE. Net Increase: 460.29%

Conclusion

My contention has always been that you should have a small side hustle to supplement your income, pay off debt or add to savings. I know that it’s easy to get pulled into some multi-level marketing thing from Mary Kay to Herbalife, but I seriously feel that those things are not what your focus should be on. Something tiny that genuinely interests you or some area in which you already have a talent that you can exploit is where you should be. If you are a wonderful baker like someone in my office, you should be hawking cupcakes at the local flea market (been there and sold at the flea market). If I was good at knitting I’d be selling my crazy creations on Etsy or to small small boutique (been there and sold stuff to local boutiques too). Also, a non-traditional investment vehicle such as peer-to-peer lending can lead to returns that are better than the market as well. Just remember to evaluate your  own tolerance for risk before jumping in.

own tolerance for risk before jumping in.

Profit: +$2,801.45

Income: +$9.92

Incentive: $+0.01

Total: +$2,811.38 or +181.14% over my initial $1,000 investment

Finally to the other challengers: HA, HA!