At the end of January while I was snowed in one day, I sat down and threw a few of the rules that many personal finance experts recommend right out the window. I applied for three different credit cards in one sitting. Egads, you say! Yes, three new credit cards. I know that you want to ask what could possible have motivated me to do that and you’re probably concerned that I am developing bad habits that will plunge me back into debt. Not at all. What I’m doing is using my credit wisely.

The three cards that I added each have 50,000 point rewards when spending requirements are met. Since I plan on paying the property tax for both of my rental properties and dropping a couple thousand bucks on my wedding, it made sense to put those large sums on each credit card so that I could be rewarded with 150,000 points worth a decent sum – depending on how I used them.

I had planned on using those points for free round trip tickets to Europe and free hotel stays on my honeymoon, but alas, life intrudes and I won’t be headed to Europe this year. What have I done?! I know that you’re thinking that my credit rating must have taken a kick to the knees. Quite the contrary. My credit score has actually increased.

One of the new cards that I have gives me free access to my actual FICO score. Even after opening three credit cards, my FICO score is still well above 740 – the widely regarded cut off for obtaining the most favorable credit rates. Not bad, I guess, but there were some changes with my credit profile that could have seriously affected my rating. I hopped over to CreditKarma.com to check out trends with my credit profile for free.

Sidebar: If you don’t know what Credit Karma is, you’re missing out. They provide free information that is useful for monitoring your credit. Just don’t sign up for the offers and you’re good. Credit Sesame is a competitor and they do the same thing as well. I use both because they’re both free.

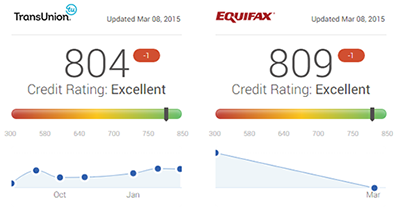

Credit Karma provides your Vantage 3.0 score from both TransUnion and Equifax. Note, I didn’t say FICO score, I said Vantage score. You have a bunch of difference scores that are tied to your credit. Your FICO score created by Fair Isaac and Company (FICO) is usually what creditors refer to when they use the term “credit score” but you also have other credit scores as well. The score that your auto insurance company uses is a totally different number as well. Your Vantage score is a separate credit score that more and more creditors are adopting.

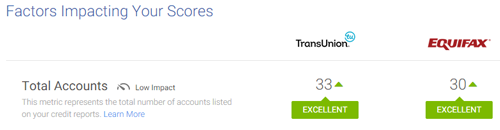

When I log into a free site like Credit Karma or Credit Sesame, what I really look for are trends. According to both services, my score has gone down a whopping 1 point since all of the new cards were reported. When I looked at the trends, my TransUnion score actually went up 13 points since applying for the three cards. How is that possible? Well, you fell for the trap of thinking that opening credit cards is always a negative thing. Credit, when used wisely, is not evil. Let’s explore.

Your credit score is comprised of a number of different elements, however, five take precedence over others: payment history, credit utilization, average credit age, account mix and credit inquiries. Also high on the list is the presence of derogatory marks such as collection accounts, tax liens, civil judgments, bankruptcy, foreclosure, etc. These types of occurrences are typically captured somewhere in the other five as well, but it’s important to list this here as well.

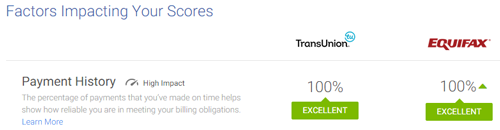

So, looking at my payment history, I have nothing ever listed as being paid late or being in arrears. We’re talking about going back years here. Since my payment history which accounts for about 35% of my credit score wasn’t affected by opening these accounts, there’s nothing there to look for. Whatever you do, always be sure to pay at least the minimum payments on your debts. Keeping a 100% on time payment history will allow you to negotiate with your creditors as well, should you ever need to. If you do happen to pay something late one time, this will give you leverage when you call them up to ask them to remove the late payment history from your record. Most creditors will do this if it’s a one-time occurrence.

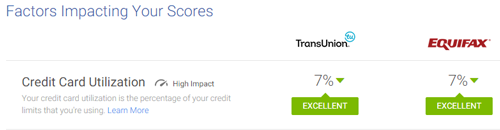

Next up is my credit utilization which accounts for 30% of my credit score. This is where I struck gold. Because I added about $60,000 to my available credit by adding these new cards, my utilization ratio plummeted. To get your utilization number, divide the total outstanding balance by the total credit allotted to you.

It is recommended that you keep your utilization ratio under 30%, but that’s not always true. If you have a really low available credit limit, it’s okay for that number to creep up. If you only have one credit card and the credit limit is $500, I don’t believe that you’ll be penalized as severely as if someone with a $20,000 credit limit across ten cards but who consistently carries a $10,000 balance. Yes, their utilization rate is both 50% but the issuing creditors have a great risk exposure with the higher balance than the lower balance. Then again, someone with that a higher credit limit has been judged to be more credit worthy, so, you never know. If you have a high balance but pay your card off every month, none of this really matters to you.

The other thing to remember is that your utilization percentage of ratio this isn’t limited to just the balance and credit limit of one card. You’ll want to tally the total balance across all of your credit accounts against the total limit of all of your accounts. So, you can have one card maxed out but still have a decent utilization rate if you have enough available credit on your other cards. It is believed that the sweet spot for utilization is between 5% to 7%. My ratio fell to 7%. Lucky me!

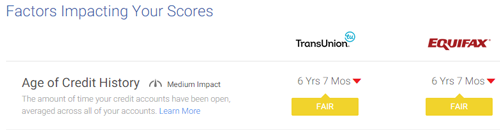

Don’t think that everything was all rainbows and roses for my credit profile. I was negatively impacted when the average age of my credit accounts, which makes up 15% of my credit score, fell. This metric dropped because I added three new cards that are the equivalent of newborn babies in age. My oldest card is from my freshman year of college and it’s one month shy of its 18th birthday now. My baby has grown up! The average age of my accounts is now 6.61 years, down from 8.42 years. The optimal age of your accounts is 9 years and above. Bummer.

If I wanted to raise the age of my accounts, I could simply close one of the new cards. I’ll most likely close two of these new accounts as soon as I have the rewards points safely moved over to an airline carrier. This will raise the average age of my credit accounts but lower the amount of available credit that I have an increase my utilization ratio. None of this would matter if I didn’t carry a balance, so remember, closing credit card can actually improve your credit score. My oldest card is never going anywhere if I can help it since it helps to pull the average age of my cards up. I plan on being buried with it.

Up next is my account mix which comprises about 10% of your credit score. Creditors like to see that you can tackle different types of debts. If all you’ve ever had are credit cards, you might not be an attractive candidate for a personal loan because you’ve never had a history of dealing with that type of debt. I have a mix of mortgages, credit cards, auto loans, student loans and personal loans on my credit profile. They all have excellent repayment history and no delinquencies which makes me attractive to different types of creditors and lenders. See, my debt is good for something.

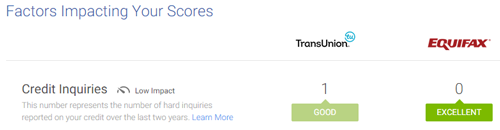

Finally, the number of credit account inquiries makes up 10% of my credit score. You might hear this referred to as “hard pulls”. You can look at your credit score all you want and it will not impact your credit inquiry history. This metric is affected when you apply for credit and it doesn’t matter if you are approved or declined. Generally, you want to keep this number under two over a twelve month period.

I know what you’re going to say, “But Sandy, you applied for three cards on one day.” Actually I applied for three cards in 15 minutes, but that’s besides the point. Yes, I did. I had zero inquiries going back over the past two years so yes, this was negatively affected. But the way in which I applied for these cards was the best possible. Instead of spreading credit applications across months making it appear as if I’m constantly applying for new credit, I did this all within a cluster.

Cluster applications affect your inquiry history less than if you constantly applied for accounts every month or few months. When applying for loans or mortgages or credit accounts, it is advisable that you sit and enter a bunch of applications all at once. Not only will the creditors not see that you have other applications out there at the same time, but when you make a cluster of applications it’s usually surrounding shopping around different creditors for the same event and not you desperately seeking additional credit on top of what you already have every single month.

If you look at the number of inquiries that have posted to my account, you will see that an inquiry did not post Equifax. Remember, not all creditors report to the same or all credit agencies so your numbers can differ based on which agency the creditor reports to.

Alright, wasn’t this fun? There is no absolute when it comes to your credit score. Just as opening cards improved my score, closing cards my actually raise your score as well. Credit cards are not evil. They are useful tools that can save you money when used correctly. Now that you’re armed with information on what factors affect your credit score, you won’t be surprised about what happens when you open or close new credit accounts.