Voters who demanded Washington rein in the nation’s spiraling debt are getting a message from President Barack Obama and leaders of his bipartisan deficit commission: It’ll hurt.

I’ll give it to you as a compilation of information that I pulled from around the web. Remember, you voted for it, so don’t choke on your lunch. My comments are not italicized.

A proposal released Wednesday by the bipartisan leaders of the commission suggested cuts to Social Security benefits, deep reductions in federal spending and higher taxes for millions of Americans to stem the flood of red ink that they say threatens the nation’s very future. The popular child tax credit and mortgage interest deduction would be eliminated. I would never qualify for this credit because I earn too much, but those living in poverty with kids are screwed. A 15 cent-a-gallon tax would also be imposed on gasoline.

The document makes five basic recommendations: First, to “enact tough discretionary spending caps” and find $200 billion in savings by 2015. Second: tax reform “that dramatically reduces rates, simplifies the code, broadens the base and reduces the deficit.” The third step addresses reforms of the health system. Fourth: mandatory savings from farm subsidies and civilian and military retirement costs. And fifth: reforms to Social Security to ensure its solvency “while reducing poverty among seniors.”

The draft proposal suggests raising the retirement age, altering the formula for cost-of-living increases, and raising the payroll tax threshold. The normal retirement age would rise to 68 by 2050, and 69 by 2075. For those born in 1960 or after, the full retirement age is now 67. Thankfully, I hope to be retired by then. Sucks for you Gen Y and Z people.

Under the chairmen’s proposal, Medicare spending would be curtailed. Tax breaks for many health care plans, too. And the Pentagon’s budget would suffer as well in a plan that attaches $3 in spending cuts to every $1 in tax increases. Honestly, military spending accounted for the majority of our current deficit, so they can afford to have some money lopped off their budgets with the wars ending.

The plan also calls for a major overhaul of both the individual income tax and the corporate tax systems, with the idea of lowering overall tax rates, simplifying the tax code and broadening the taxpayer base. The top income tax rate would drop from 35 percent to 23 percent.

There are lots more suggestions in the recommendation that will by far benefit businesses which makes me look at this document sideways. Here are a few: lower corporation taxes to 23%, drop the tax credit for businesses that offer medical plans for their employees, drop taxes on income that US based companies make from activities overseas, etc. The danger that I see here is that if businesses have no incentive to offer medical plans, why should they? Just because you decrease a business’ tax liability does not mean that it will hire more workers, it might just keep that money in reserve.

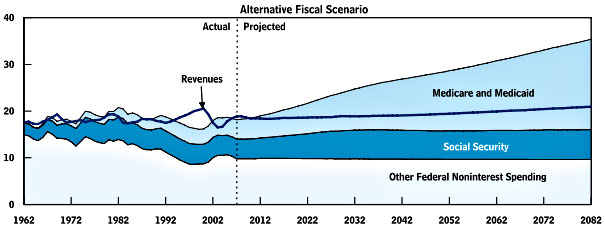

There are lots more things in this report including a huge section on Medicaid/Medicare that I want to discuss a little. We waste time with all the crap above when it is clear that these federal entitlement programs as well as military spending are the clear drags on our economy. According to the chart below, spending on Medicaid/Medicare will explode if nothing is done.

This is why I thought that reforming health care was critical in keeping our country afloat, but unfortunately, no matter which party you belong to, the entire process last summer was hijacked by a few very uninformed but vocal individuals who cared only about “death panels” and “killing grandma”. That little bump where revenue exceeded expenditures were the golden years that I like to refer to as the Clinton Era. If you are a legally employed individual in this country you are already paying for Medicaid and Medicare whether you ever use it or not. I’m for anything that will reduce my spending in this category while preserving the rights of sick individuals to see a doctor. Sorry, I’m on a rant.

Anyway, what do you think about this report? Are you scared yet?