Exactly one week ago my big, expensive refrigerator died. I had just purchased two weeks worth of groceries about 3 days earlier, so you can imagine my frustration at having lots of food spoil on top of having to pay hundreds of dollars to the repair man. Left with a ghastly empty fridge with only three things (peanut butter, pickles and baking soda) I decided to take the opportunity to prove that you can save money on your groceries every single time you shop without being an extreme couponer.

Since I had almost nothing in my fridge, I focused on purchasing things that I knew that we would be eating within the next two weeks. A problem that I have with extreme couponing is that people purchase things that they would not be able to use entirely in their lifetimes let alone by the expiration date (over 70 bottles of mustard anyone?). Fresh produce would dominate the majority of my shopping list since thankfully, nothing was wrong with my cupboards.

To prepare for my shopping trip I grabbed the coupon inserts out of my newspaper and printed coupons from Coupons.com as well as Redplum.com. Again, I only clipped coupons for things that I knew that I needed to purchase. I’m a busy woman working over 40 hours per week on top of a daily commute of almost 3 hours each day plus running this blog and other stuff. I don’t have time to spend 30 to 40 hours each week looking for coupons. If I did I would have a second job. I spend 6 minutes (timed myself) clipping coupons from the paper and another 4 minutes printing coupons from the websites. Yes, you too can be done with your coupon clipping in 10 minutes. I didn’t spend money buying coupons either.

I shop at Stop and Shop and while they had lot of sales, they were not all for things that I needed, so I ignored them. I didn’t care about building a stockpile of Kraft bar-b-que sauce (on sale everywhere right now) because I didn’t need it. I needed milk, eggs, yogurt, meats and cheeses, not more than 100 candy bars. Incidentally, those items are often the ones that are least likely to have manufacturer coupons. You can find lots of coupons for things like cereal and pasta but try to find one for eggs!

I did make one major mistake. I took BF shopping with me, and you should never take a hungry person to the grocery store. Invariably you will end up with more stuff than you bargained for magically appearing at the check out line. We budgeted $225 for groceries which is almost double what I would normally spend at the grocery store. Remember, we were starting from zero in the fridge and needed to replace some cupboard items having eaten out of the pantry for 5 days before the fridge was fixed.

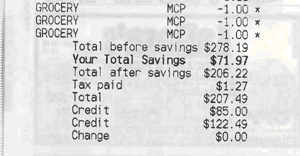

We spent a total of $278.19. Yes, we did go over budget somewhat, but that’s not the end of it. I handed the cashier my coupons and store loyalty card. After scanning coupons and my store card my total was reduced by $71.97 down to $206.22, a saving of 25.87%. My store does not double $1 coupons, nor do they double coupons that say “DO NOT DOUBLE”. If they did I would have saved quite a lot more money. But that’ s not the end of it. I paid the bill with my Discover Card which earns me 5% cash back, so I’ll get another $10.31 from Discover card bringing my total savings to 29.57%. But wait, there’s more! Stop & Shop is offering a promotion currently where every dollar spent earns 1 point. Every 100 points earns you $0.10 off per gallon of gas. On this trip I earned 207 points which is good for $0.20 per gallon off my next fill-up or I can roll it over and add more points. If I cash in my $0.20 per gallon at about 15 gallons to my tank I will save an additional $3 pushing my total saving for this trip up a little past 30%.

That’s how I saved 30% off my shopping with 10 minutes of work without having to stash rolls and rolls of toilet paper under my bed while buying things that my family will actually eat and use. You can see proof of my sexy savings at the image to the right. See, Extreme Couponing, I save money without the psychosis.

Have you saved some serious money while shopping lately? Share your experience in the comments below!

This article was included in the Carnival of Personal Finance #311 The Filboid Studge Edition hosted by Miss Thrifty.