Ever since the pandemic hit, the world has been turned upside down. In most countries, governments arranged to keep people’s livelihoods intact by issuing out income to each citizen until the lockdown stops. In America, things have been a little different.

Due to ongoing issues with congressional leadership, many homes are now barely staying afloat. We had one large stimulus check of $1,200 in 2020. 2021 started off with a $600 stimulus check for individuals with an income under $75,000. Currently, people are just starting to get those checks or direct deposits into their accounts..

While the new stimulus checks have already started to hit bank accounts across the nation, the major deadline that the IRS has to abide by is January 15th. If you aren’t aware of the rules and guidelines, this deadline might be confusing. Believe it or not, it’s all about taxes and this is why you may not end up getting a stimulus check this month.

The Reasoning Behind The 15th As A Deadline

While one could bring up the fact that people are losing faith in the government, or that many people are struggling to buy food, the truth behind the deadline is a lot more mundane. Simply put, it’s about determining when you can add the payments to your IRS filings.

If you get the stimulus payments before the 15th, they can be counted as part of your income for the year 2020. If the IRS misses the deadline, it will have to be counted as a portion of your income for the new year.

Where Is My Stimulus Payment Going To Be, And Should I Worry?

In most cases, your stimulus payment should be going directly to your bank account. However, recent news headlines revealed that the IRS accidentally sent some stimulus payments to third party tax prep firms (like TurboTax and H&R Block) instead of the direct deposit to the account. If that happened to you, the IRS will eventually get that money back and mail a check (maybe) to your attention.

After news came out, the IRS has started to work on sending the money to the right parties. This, too, is expected to be worked out by the 15th. If you aren’t sure when your stimulus check is going to be available to you, visit the IRS site’s portal to Stimulus Checks to figure things out.

If you earned more than $75,000 this year or last year, then you may end up seeing a reduction in your stimulus check. The reductions are on a sliding scale, so it’s not an “all or nothing” matter.

What Happens If You Get Your Stimulus Payments Later Than The 15th?

While it’s normal to get antsy about getting money deposited in your bank account, there’s no need to panic if it arrives later than the 15th. The IRS will still send you the money. However, there will be a slight difference and a bit of a struggle when it comes to your tax returns.

If you do not get your stimulus payment by the 15th, then you may have to claim it as a missing payment on your 2020 tax returns. In this situation, you will have the $600 stimulus refunded with your 2020 tax refund. So, you might not get it by January, but rather, by April.

Why Wouldn’t You Get A Stimulus Check?

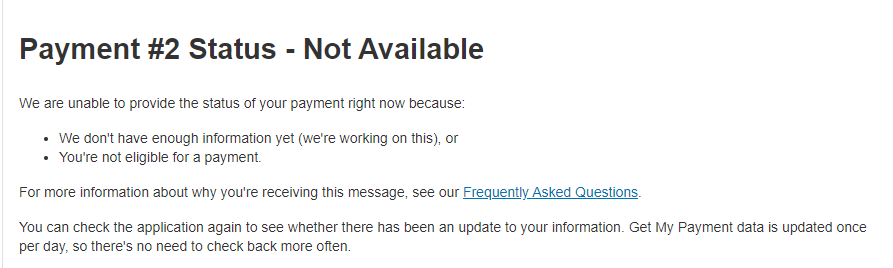

If you get a notice saying that there’s insufficient information to send your check to, don’t panic, you’re not being audited. Assuming that you don’t make more than $75,000 if you’re single (or $150,000 if you’re married), then you should get it.

The most common reasons why you wouldn’t get your money deals with a checking account that isn’t up to date, or a lack of tax returns. So, if you’re worried about not receiving money, now would be a good time to start checking out the IRS site for information on how you can get caught up.

Finally, of course, if your income was above the thresholds set by the government, you also would not qualify for a payment.