It is now almost the end of January. If you have not already abandoned your New Year’s resolutions, this is a great time to solidify a resolution that is probably already on your list – getting out of debt. Or at least, it’s prime time to begin formalizing a plan to get out of debt in 2012.

I know that you probably go to work and pay your bills religiously, but you might feel as if you’re going nowhere. I did the same thing for years. I woke up every morning with the ominous shadow of a huge debt and the threat of being sued by the landlord of the commercial property where my business had been located, for future rent. Anxiety and TUMS ruled my life, but still, I paid my bills on time.

At that time I felt as if I was stuck on a hamster wheel. I went to work every single day, paid as much as I could every single time my paycheck hit my bank account; but yet, I would check my account balances the following month only to see that I had barely made a dent in my overall debt. Interest pretty much consumed everything that I paid. I felt, in a word, stuck. I was stuck at a job with a verbally abusive boss because I needed the money to pay my debt. Or, I felt that I did.

I don’t want you to feel that way. I don’t want you to purchase enough TUMS to be a Class A shareholder of the company. I want you to be able to wake up every day the same way that I do now – greeting every day as an awesome blessing to be alive, pregnant with the promise that every new day is an opportunity for improvement.

I’ve thought very long and hard about how to best accomplish that. Some of my blogging friends and colleagues have written e-books, published paperback books, and full on courses on how to get out of debt. I applaud them for their efforts, and I can recommend some very good books to you. But, something about selling you a get out of debt course for $97 did not sit right with me for two reasons:

- It felt awfully disingenuous to me that I would tell someone struggling with debt to shell out $97 to buy something to help them get out of debt. That’s money that could be put towards a bill payment. I know that when I felt as if I was drowning in debt, I would have tried anything that someone I trusted recommended. Such a mental state leaves you open to becoming victimized by any number of vultures claiming to sell you the one thing that you absolutely need right this second that will change your life forever! But act now, because it’s only $19.95, and this low introductory price will never be offered again. I don’t want to be one of those vultures.

- Getting out of debt is actually pretty simple. If you remember elementary school math, this will help you:

Money Earned >= Money Spent

If you need that equation translated, here it is in plain English. The money that you earn must be greater than or equal to the money that you spend. Most of us tend to be okay with the left side of the equation; it’s the right side that’s the problem. I know that many of you will probably disagree with me and say that you’re just not making enough money, but trust me, that’s usually not the case.

Since getting out of debt is so simple, why aren’t we better at it? This part really IS simple. It’s because we

don’t have a plan, or a roadmap for getting to where we want to be. I’ll use an analogy from my boss: it’s like drive to California from the East Coast without a GPS. You know that if you drive west long enough you’ll get there eventually, but it would probably be easier and quicker to get there with a GPS.

This is your GPS.

After three years of working on my own debt, it’s time to begin sharing some of the techniques that I’ve learned with you. Over the next 12 months we’re going to go through this process together. My plan is that after this year, you will successfully be on the path towards debt freedom, and you should be able to sleep freely and easily.

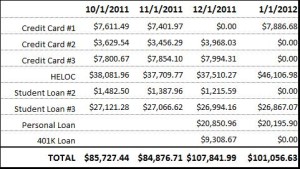

If you’re a long-time reader (love you), you might follow my monthly posts (usually on the first or second of the month) where I spell out my debt, how it was impacted and how I made some extra money during the month. This is the cornerstone of my blog, because it’s also the cornerstone of my debt reduction plan. If you’ve never really sat down and look at all of your debt in one place, you may need to prepare yourself. Your first task is to gather all of your debts and put the totals together somewhere.

I used to compartmentalize my debt. I owed student loans this much on this loan, this much on that loan, oh and this much on the other loan. I owed Macy’s this much every month. I owed the MBNA MasterCard that much per month. It wasn’t until I really sat down and wrote down my how much I actually owed each of my creditors and what my minimum monthly payment for each of them was that it really hit me. I was in some deep shit and the money that I threw at my debt every month was never going to plug the hole. Seeing all of your debt in one together in one place gives you real and lasting perspective. It’s like a having ice cold water tossed in your face in the middle of winter.

It’s up to you to decide how to do this. You can start with a little notebook if you’d like, or an Excel sheet if you’re more electronically inclined. If you’d like to go a little further and take advantage of some online tools, I would suggest signing up for a program like Mint. It’s completely free and creates all sorts of little charts and graphs for you. Again, visual tools have an amazing way of putting things into perspective for you.

So, this is your homework. You are to gather all of your debts within the next two weeks and either write them down or enter the totals into free software. We’re not going to tackle recurring bills such as your phone bill or car insurance just yet. At the very least I’d like you to enter your consumer debt into a program or notebook and total them all up. I’d also like you to know what the minimum payments and interest rates are on these debts. This can look any way that you’d like it to look since no one will see it except for you.

In about two weeks, we’ll take a book at the “B” word (budget). I hate them, but you’ll need one for the first two months at least while we get you on track. Plus, J. Money says that Budgets Are $exy!

Give me some feedback. Do you have more debt than you thought?