You know how you make a mistake and you’re so embarrassed by the mistake that you hide that mistake on the back of a shelf in a deep, dark corner somewhere hoping that no one ever discovers it? Well there are no such secrets here. I screwed up big time and I’m sharing it with you so that you don’t make the same stupid mistake that I did.

I had a little bit of money in my last employer’s 401(k) program. I finally decided to manifest my destiny and rolled it over into an IRA with Fidelity. Now, I have a world of investment options open to me and I’m not limited to the funds that my former employer chose. Great move on my part, but I messed up pretty badly when I did all this and I’m kicking myself in the shins.

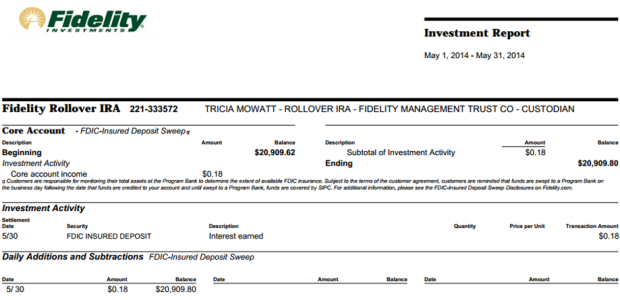

When I transferred the funds, they went from one Fidelity account help by my former employer to my own. Fidelity exchanged the funds in the 401(k) for similar funds in their portfolio. If no applicable fund existed, the cash value of the traded fund was left in my account for me to do with as I wish. The cash came out to about $26,000. I purchased$5,000 of a stock that I was excited about and left the balance of the cash in my account…for months. I’ve done nothing with nearly $21,000 in cash for months now. How is that a screw up? Take a look at part of my statement. You can click to enlarge.

If you’re too lazy to click let me give you the enlarged version below:

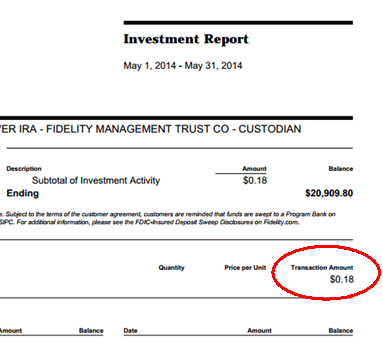

I began the month with $20,909.62 in cash. I earned a whopping $0.18 on my money and ended with a total cash balance of $20,909.80. What a horrible screw up!

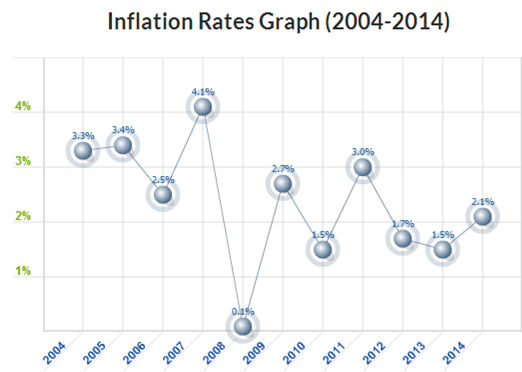

But you earned 18 whole cents on your money, you’re thinking. You didn’t lose any money in investments, you’re thinking. Wrong. I lost money. Since I’m earning a whole 0.01% on the cash help in my account and the annual inflation rate is pegged at 2.1% for 2014, my money  actually lost some buying power. In order to keep the same buying power, I need to earn at least an amount equal to the rate of inflation. What an idiot I’ve been by holding this amount of cash in my portfolio.

actually lost some buying power. In order to keep the same buying power, I need to earn at least an amount equal to the rate of inflation. What an idiot I’ve been by holding this amount of cash in my portfolio.

If you take no risks you reap no rewards either. The $5,000 that I used to purchase individual stock fell by 40% in the past two months. As of June 19, it’s I’m only down 13% on that position, but my other holding have pulled by rate of return up to 7% on the plus side. Am I doing gangbusters? Heck no, but at least I’m not losing my by having cash sit in my account waiting to turn to dust.

Inflation is not your friend. If you have a large amount of money sitting in a regular old checking or savings account head over to your local friendly banker and ask what interest you are earning on your money. If you’re not getting something that will outpace inflation, I would caution you to think about doing something else with your money. Don’t be an ass like I’ve been. Since I’m retiring by 40, my money needs to work even harder than I am.