We’re talking about mortgages again. I promise you that I am not beating a dead horse but since this is the most expensive thing that most of us will every pay for, and since so many people are defaulting, I can’t help but covering this topic from many different angles.

I wrote a post called, 30 Year Mortgages Are For Suckers which ruffled a bit of feathers. Some of you agreed and some disagreed, but I want to back my argument up with the viewpoints of some financial gurus as well.

According to Suze Orman,

“If you are 45 to 50 years of age and are going to stay in your house for the rest of your life, and you have a mortgage payment, I will forever say that one of the best things that you can do with extra money is pay down your mortgage. Why? You have to generate that money somehow to pay off that mortgage. It’s far easier to pay it off now than later.”

Dave Ramsey says that,

“It is a great thing to have a paid for house. We have done in depth research and we have discovered that 100% of foreclosures have occurred on folks with mortgages. If you’ve finished saving 6 months of emergency money and paying off your credit card debts, any other money above what you save for the kids’ college and 15% of your income going to retirement should be dumped into the mortgage. You want to pay off the mortgage as fast as possible. As soon as you pay off your mortgage, take off your shoes, walk through your back yard. The grass feels different.”

You know why? Because it’s YOUR grass now. No one can come yank it away from you. That is, unless Bank of America comes by and mistakenly forecloses on a home that they don’t own. Again. It doesn’t matter if your home’s value goes up or down because you plan on staying there for a long time – possibly ’til death do you part.

Let’s work on some math with this scenario. Let’s say that you have a $200,000 mortgage at 6% for 30-year fixed and your payments are $1,200 a month. How much money do you have to have in a 401(K) to generate $1,200 a month after taxes? $1,200 a month is $14,400 a year. You need approximately $400,000 in a 401(k) at 5% generating $20,000 a year that you pay taxes on to pay off your mortgage.

So you’re probably asking why not just take the money and put it into the stock market and get some interest on your money. Sure, the stock market is soaring right now, but do you remember that horrible period in 2008 and 2009 when the stock market tanked? I lost a little over 30% of my 401(K) balance. How did your portfolio do during that time? How much risk can you stand? Paying off your mortgage faster absolutely guarantees that you will save money on the total interest paid on your mortgage in the long run.

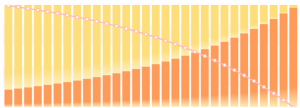

What about the mortgage tax deduction write-off? The average homeowner keeps a home for seven years. During the first bunch of years that you are paying your mortgage, much of the interest is front loaded. That’s the pretty little chart shown below. If we continue with our $200,000 home scenario from above, in the first year out of $14,389 in payments, about $11,933 of that is interest. That’s a lot of money spent. The longer you extend the mortgage the worse it works against you. After 20 years of paying on that mortgage you will you still owe almost $100,000. How much is that tax deduction worth to you now?

So let’s go back to our original loan where the monthly payment is $1,200, and you decide that you want to send in an extra $100 every month. You’ll take a 30 year mortgage where you would have paid over $431,000 in principal and interest down to 25 years and you would have paid a little over $382,000. That’s a saving of almost $50,000 and 5 years of payments with no refinancing required!

So back to the original question again. Do I max out the 401(K) first or do I prepay the mortgage first? I would plan on paying off my mortgage. If I pay off my mortgage, I won’t need to save as much in my 401(K) because that huge monthly bill will no longer exist. If push comes to shove and I’m in dire need of cash in my retirement, I would consider a reverse mortgage, renting a room in the home or selling the house. You will have options available to you!

Yes, 30 year mortgages are still for suckers if you plan on dragging it out for that long. If you are prepaying, I love you for it. Should you invest in your 401(k) or prepay the mortgage? I’m not telling you to NOT invest in your 401(K). I would put the minimum amount required to get the maximum employer match from my company. Then I would advise you to pay down as much as possible on your mortgage whenever you find yourself with extra money.

You can learn more about how those extra payments add up with my primer on the biweekly mortgage.