With banks paying virtually nothing in interest on small accounts, I turned to Prosper.com last year to possibly increase my rate of return. It’s time to see how the initial loans that I made are doing one full year later.

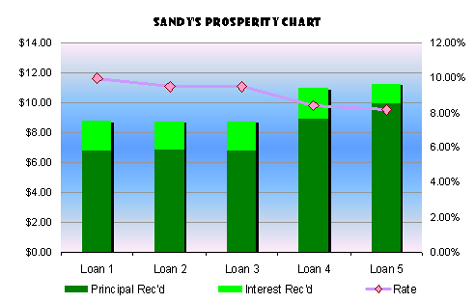

Out of 11 loans, 5 are just about one year old. In the interest of fairness, we will look at just those five. I loaned $25 to each of the 5 borrowers for a total of $125, with an unweighted average interest rate of 9.12%. I have received a total of $48.48 in principal and interest from these loans. Instead of writing this all down, why not review it all in chart form?

My Prosper loans aren’t doing so bad, but if you look closely, you’ll see that one row is in red. That’s because that loan is currently 15 days past due. All other loans are current. Even through the other loans are performing well, if loan #3 defaults, it has the ability to wipe out just about all of the gains that I will make on the other four loans.

If you remember, I wrote a post entitled,“Finance 101: What the Heck is Peer-to-Peer or P2P Lending?“ just over a year ago. In my post, I urged you to not invest more than you were willing to lose. So, if Borrow #3 defaults, I will be okay. Also notice that I spread my money around. I almost never invest more than $25 with any one borrower, and invest only with borrowers rate “A” or “AA” with no previous collections to reduce the risk of default. I have 6 loans in addition to the loans that I have listed above. Of those 6, one is also 15 days behind. Should this person default, he will definitely affect my return, but he won’t wipe it out completely. One person has paid off their loan only 5 months after origination, which netted me $1.57 in interest. That return is actually much, much higher than ING or any local bank would have paid out in the same time frame.

So, how’s Prosper doing? Well, I’m doing better than most individuals that I know, but it’s not perfect. I have made some money, but with payment terms of three years, there is a substantial risk that more borrowers will default. Again, I have only invested money that I was willing to lose.

I still think that peer-to-peer lenders as a whole will be major competitors for banks when it comes to micro finance and small individuals loans. Small businesses are also finding it difficult to obtain loans, even with decent cash flow and a winning business plan. Getting a small business loan with bad credit is nearly impossible, but the peer-to-peer lending institutions have the potential to dominate this market and help drive an economic recovery. And if you and I can make some money in the process, why not?