For the last few years, I’ve been touting the potential benefits of peer-to-peer lending, especially if you have a small amount to invest, and are not too risk adverse. As I have done for the past three years, I put my money where my mouth is, and I’m prepared to show you exactly how my own lending portfolio with Prosper.com is beating the pants off conventional savings accounts, CD’s, money market accounts and high-yield checking accounts. This is a review of how my investments have performed after a full three years as a Prosper.com investor.

First, if you don’t know what peer-to-peer lending is, please read my primer, Finance 101: What The Heck Is Peer-to-Peer lending? A short explanation of the process is that two major companies, Prosper.com and LendingClub.com provide a platform where you act as a lender willing to lend money to someone in the general public seeking a loan. Your small investment (I recommend no more than $30 for each loan) is pooled with investment funds from many other lenders. Your rate of return is determined by how risky the platform determines each borrower to be. While there are opportunities for large gains, you also risk losing your entire investment including your principal.

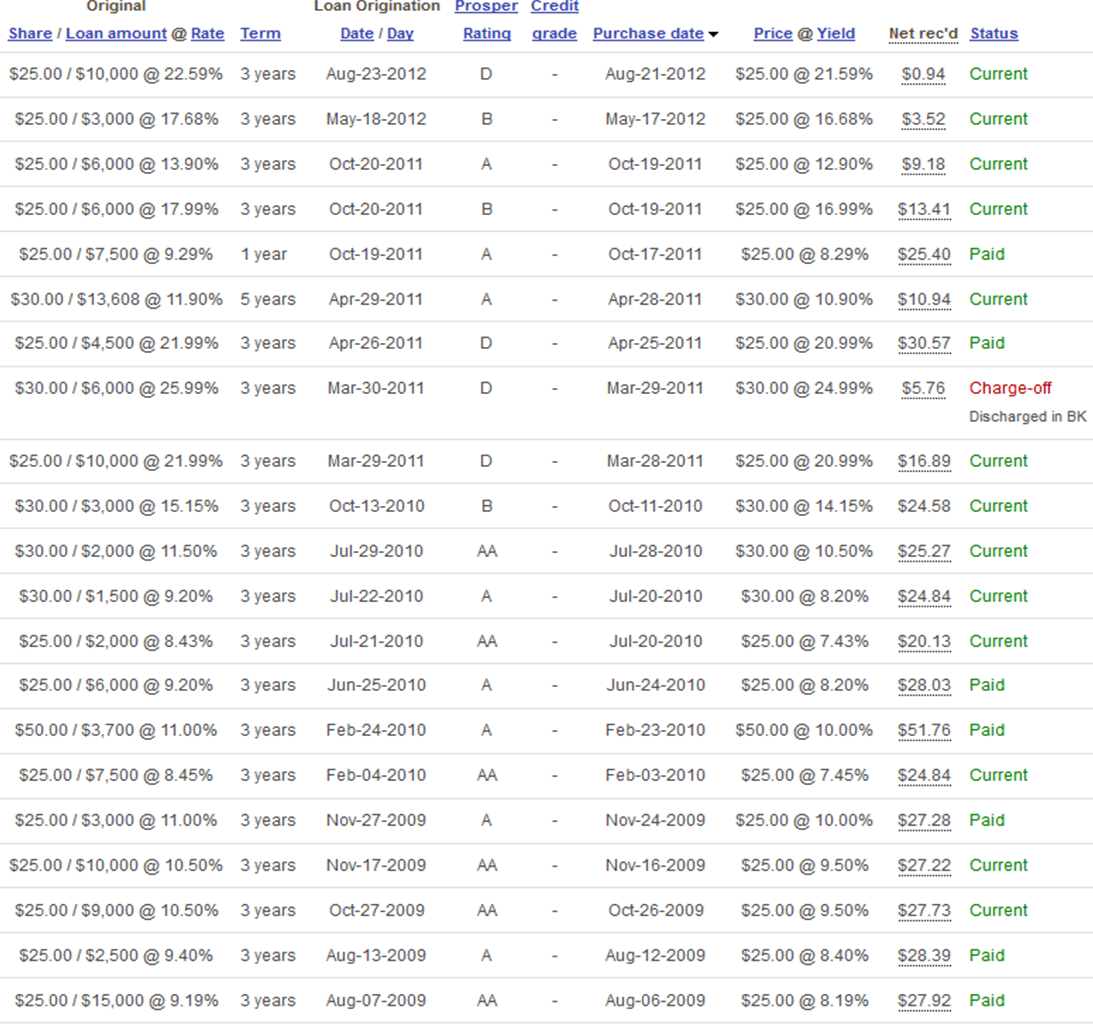

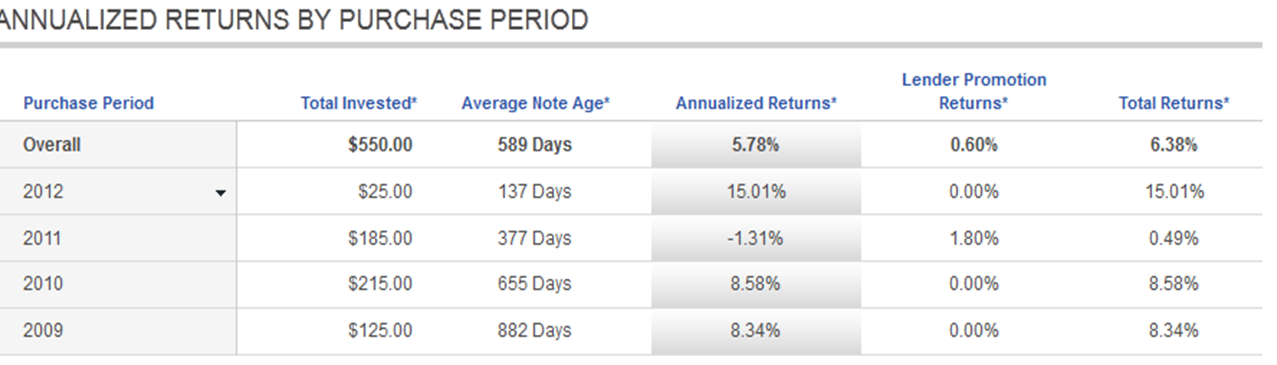

I initially invested a total of $400 into my Prosper account, changed my mind, and reduced my investment funds down to $300. In the past three years, I have not added one penny to the Prosper account, instead recycling my funds as loans are paid off.

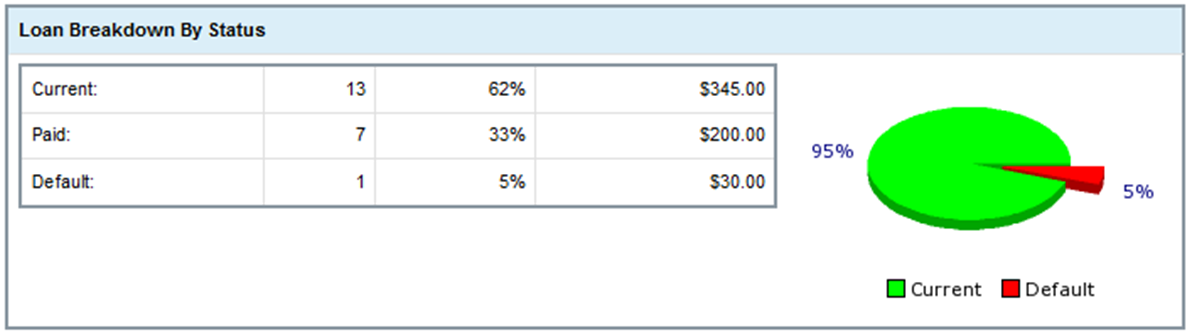

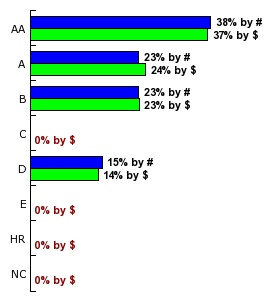

I bid on a total of 53 listings of which 21 converted into actual loans. Out of 21 loans, 13 are current, 7 have been paid off, and 1 defaulted only two months after origination. So far, I’ve had a 95% success rate in choosing my own funds. You can read a little more about that defaulted loan in my review from last year. I broke my own rules about investing (also on that post) and got burned. Lesson learned.

While lending through the peer-to-peer networks is very risky, the returns have far outpaced any interest that I could have had through a traditional savings account. The savings account that I had at a big bank wass returning a rate of 0.01%. Yes, the decimal is in the correct place. Had my $300 been sitting in that account, I would have earned a whopping 9 cents on my $300 in this time. Even if the rate had been increased to a decent 1%, I still would have earned only $9.09 my money.

With the charge-off taken into consideration, and one or two investment incentives from Prosper.com, my original $300 portfolio now has a total of $345.44, about a third of which is cash that I have not invested, because I’m sometimes lazy with my portfolio.

Let’s compare? At best, with a bank I could have earned $9.09. With Proper.com I’ve earned $68.58 in excess of principal, of which $27.54 was deducted for a failed loan and $4.40 was added as an investment incentive. And just think, I didn’t have all of my cash invested in loans for that entire time.

If you are reading my results and smacking yourself for not investing sooner, it’s okay! This kind of lending is risky. I would be absolutely remiss if I did not say that because, as evidenced through the one loan charged off, you can lose your entire investment amount. That is why I still recommend the following strategies:

- Don’t invest more than $30 in any one loan.

- No one with low credit ratings.

- No loans to people using it for business.

- No loans to people buying a home.

- No loans to people wanting to use it for a wedding or engagement.

- Don’t believe the hype. Everyone has a story.

- If you have a history of defaults and delinquencies, I can not help you.

- No loans for a total above $10,000.

- Avoid 5 year loans if possible.

- Look for repeat borrowers.

I’m going to continue being a snob about who I am willing to invest with. Even though I am engaging in an inherently risky investment vehicle, I want to lower my risk as much as humanly possible.

Now, is this something that I recommend that you dump all of your cash into? Absolutely not. I do, however, think that this could be one part of a balanced portfolio. Your age, the amount of time left until retirement, your requirements within retirement and other factors should determine the amount of risk that should be included in your portfolio. My returns are not a guarantee of your returns.

Either way, I’m beating the pants of the big banks and I am not using a lot of money to do so. If you’d like to learn more about this investment option, check out Prosper.com).