Last year I reviewed how my lending account with Prosper.com was doing. I thought I would continue along those lines and share how my account is doing after the two year mark. If you don’t know what Prosper.com is, it is one of the largest peer-to-peer lending networks in the country. Prosper.com and its rival, LendingClub.com gives everyday men and women like us the opportunity to effectively become bankers, lending our money out to others in the hopes of attracting a really good rate of return. You can read all up on how it works on Finance 101: What The Heck Is Peer-to-Peer Lending?

My first loan originated on August 6, 2009. Since then I’ve had a total of 16 loans on Prosper.com., three of which are paid in full and one currently less than 15 days late on a payment. We’ll get back to that one in a moment. You can view all of my loans and their terms in the lovely image below. By the way, they provide this information to you.

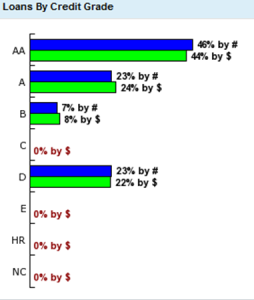

To be sure, I have been an absolute snob when it comes to who I am willing to lend to. First, the majority of my borrowers have an “A” Prosper.com rating. These are usually individuals with credit scores of at least 725 with good credit histories. I have purposely focused on these individuals because they tend to care about their credit scores and are less likely to default. This lower risk means a lower rate of return, but I am willing to accept that. You know the old saying about a bird in the hand. You can see how my loans break down by grade to the right.

You will notice that four of the last five loans totally contradict what I have been doing for the past two years. These loans have “D” ratings meaning that there is a significantly higher possibility that these lenders will default, but because of the interest that they are paying me is also much higher. I chose to invest in these loans after Prosper.com ran a few promotions highlighting these specific loans. The promotions will usually instantly give you cash back for investing a certain amount in what they call promoted loans. If I am willing to invest, say $25 in these loans they sometimes give 3% or a specific dollar amount back instantly. Sure, these loans might default, but you have to be willing to take that risk to get the higher yield.

Speaking of default, I have been lucky (knock on formica) that none of my loans have defaulted so far. That might change soon though. The loan currently showing less than 15 days late has consistently been paid late since its origination. Out of the $30 that I loaned this person, I have received $5.76 back so far of which $3.43 was interest. I totally went against my own rules of who I was willing to lend to because this was a promoted loan for which I received an incentive to invest. My lending rules are pretty strict and are as follows:

- Don’t invest more than $30 in any one loan. Anything more than that and you are asking to be wiped out if someone defaults.

- No one with credit ratings below “A”. I’m a snob and I know it. But again, I put this rule to the side when there are incentives or when I really, really want to help that particular person.

- No loans to people using it for business. Sorry, but these days too many businesses are failing for me to be comfortable investing in one…unless it’s for a small amount (under $2K for short-term inventory use).

- No loans to people buying a home. You should have enough money saved for that. Sorry.

- No loans to people wanting to use it for a wedding or engagement. You can have a cheap wedding. I don’t believe in helping you spend money that you don’t have when you can get the same results (being married or getting engaged) within your own budget.

- Don’t believe the hype. Everyone has a story. The more of a sob story the better, but the story angle should not matter. What should matter are the numbers.

- If you have a history of defaults and delinquencies, I can not help you. You have not yet learned how to be responsible.

- Nothing above $10,000. The larger the loan, the higher the payment and the higher the risk of default in my book.

- Avoid 5 year loans if possible. It just gives someone too much time to default. Situations can change rapidly in 5 years.

- Look for repeat borrowers. History is a good indicator of future behavior.

These are my own rules. You have to come up with rules that will work for you. I’m risk adverse, so I’m extremely conservative.

If, no I mean when, that loan defaults it will not take my entire return with it. I have received $40.78 in interest and incentives so far on an investment total of only $450. If I lose the remaining $24.37 on that late loan, I will still be ahead and would still have made far more than a savings account. Even ING Direct is paying less than 1% on savings accounts these days. If I wanted to, I could try to sell this loan on the open marketplace, but I would have to discount it significantly. I’m willing to take my chances and see what happens. If I had a loan for a larger amount I would probably consider selling it.

If you have not yet added a peer-to-peer lending account to your portfolio, I encourage you to do it today. You can sign up with either Prosper.com (my favorite) or LendingClub.com. If you’re on the fence about investing, don’t worry, I plan on listing my own loan in the coming weeks. It will be my third loan and I can guarantee that I won’t default. You’d run me out of the blogosphere if I did.

Questions about my Prosper portfolio or investing in peer-to-peer lending? Ask away and I’ll answer as best as I can. Do you have a peer-to-peer lending account? How is it doing?